Fitch Ratings has downgraded the outlook of Thailand’s banking sector in the face of weakened economic momentum and increasing exposure to bad debts, but further downside is limited given the country’s economic and financial stability.

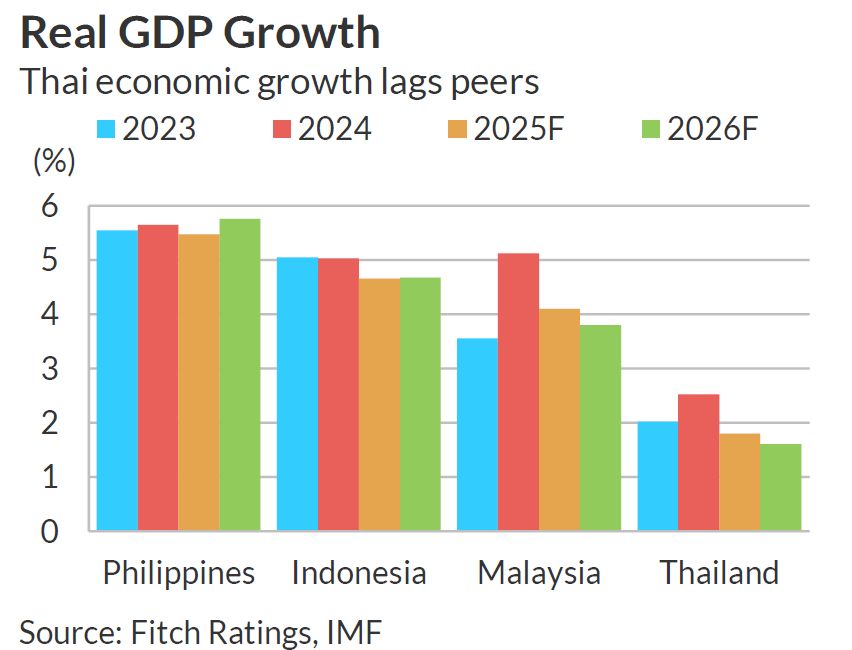

The rating agency has changed the sector’s outlook from “neutral” to “deteriorating” as Southeast Asia’s second-largest economy struggles to maintain its growth momentum. The country’s GDP is expected to grow below 2% in 2025, the lowest among regional peers, says the Fitch report.

Banks’ asset quality will take a hit in a sluggish economic environment. Lending activities will potentially be hindered by restricted business opportunities, with harsher constraints on deleveraging. The rate cut cycle, which began in the fourth quarter last year, will further limit the banks’ lending margins.

In addition, the high leverage ratio among corporates and households adds to the pressure of bad debt burden and undermines loan growth.

However, Fitch believes the downturn in the banking sector will bottom out as a result of the stable operating environment and the country’s low unemployment rate, which underpins repayment ability, alongside improving GDP per capita and a robust financial system.

“We expect economic conditions, while deteriorating, will not worsen to a substantial degree and labour markets will remain stable – helping to prevent sustained downside to banks’ key metrics,” the report says. “Furthermore, the improvement in banks’ earnings since the Covid-19 pandemic provides some headroom to handle short-run weaknesses.”

Fitch has considered Thailand a credible sovereign with an investment-grade rating of BBB+ for 12 years in a row.

Meanwhile, adequate domestic liquidity and lower interest rates will smooth out refinancing risks and lower funding costs for the country’s non-bank financial institutions ( NBFIs ), Fitch says in a separate report.

Thai banks’ profitability has resumed an upward trajectory after Covid-19. Prior to the economic uncertainties driven by the US tariffs, the outlook for major Thai banks such as Bangkok Bank, Kasikornbank, and Siam Commercial Bank has improved due to better financial performance and post-pandemic economic recovery, despite an interest rate cycle that potentially limits loan earnings.