The elevated valuation of AI infrastructure, particularly the build-out of data centres, is becoming a concern for some of the world’s largest investment firms as 2026 nears.

“Are we going to start to see some cash flows and monetization of all of these AI investments?” asks Sergio Ermotti, group CEO of UBS AG, at a panel session during the Abu Dhabi Finance Week 2025.

“It's important to understand if the non-tech industry will start to benefit from that kind of evolution,” he says, as he expects 2026 to be another challenging year.

UBS CEO Sergio Ermotti

UBS CEO Sergio Ermotti

His views were supported by Oliver Bäte, CEO of Allianz SE, one of the world’s largest investors via its two units – Allianz Global Investors and Pimco – which together manage over €2.6 trillion ( US$3.04 trillion ).

“We are probably one of the most conservative investors here,” he shares. “We would rather invest in the shovels – that is, the grids, the battery storage technology, etc. Before you talk about data centres, you need the power to make data centres work. And we don’t see a lot of that coming yet.”

Allianz CEO Oliver Bäte

Allianz CEO Oliver Bäte

Outlook solid

Clare Woodman, CEO of Morgan Stanley International, however, believes the outlook for digital infrastructure remains solid. “There is still very broad-based demand,” she argues. “Our researchers forecast that out till 2030, there’s probably about US$3 trillion of demand for data centres.”

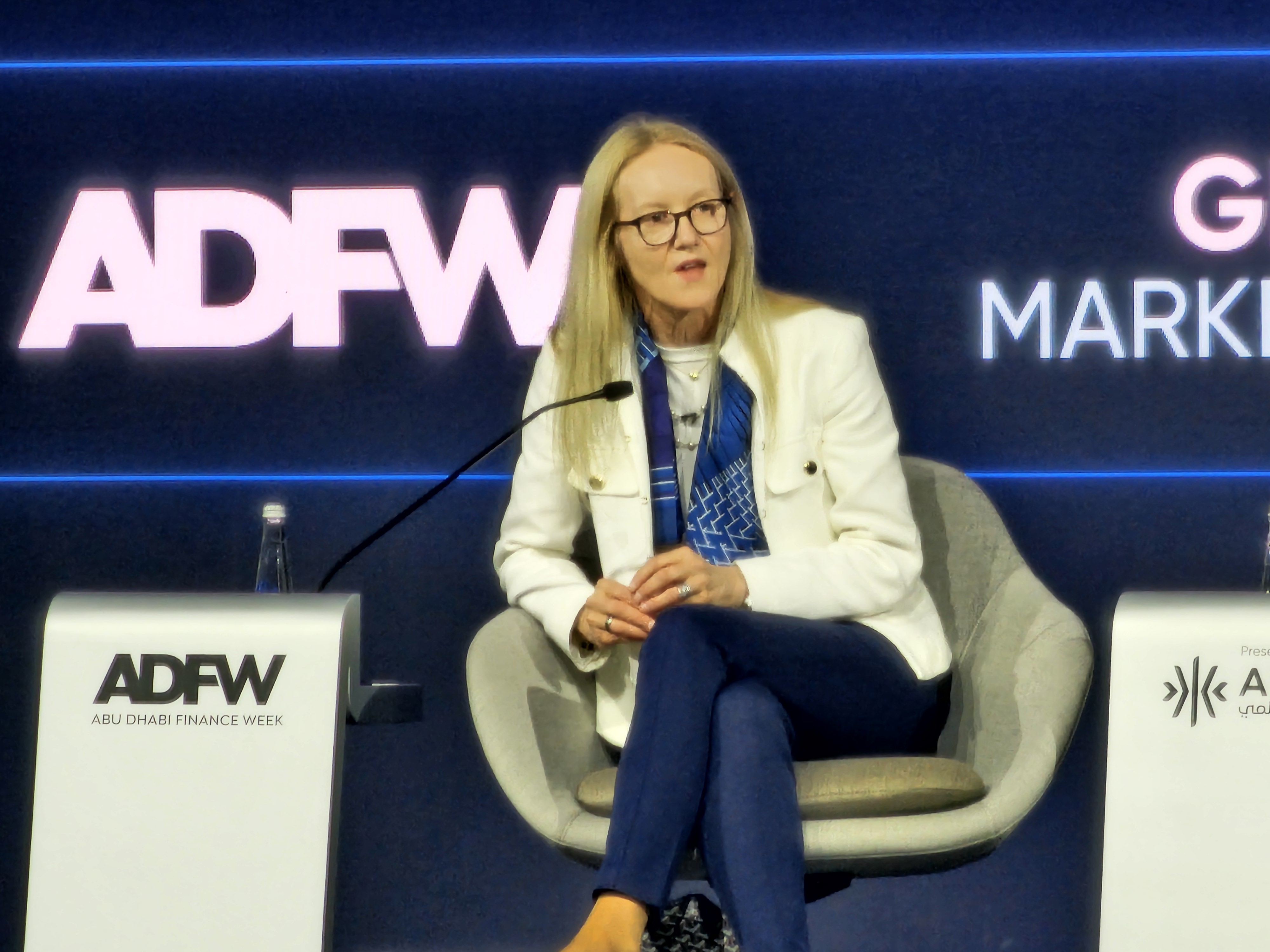

Morgan Stanley International CEO Clare Woodman

Morgan Stanley International CEO Clare Woodman

She insists demand for faster processing remains strong, while acknowledging bottlenecks as well. “Where we have highlighted areas that we think will be big focuses and questions are around the availability of power to generate data centres.”

Woodman describes it as the intelligence factor, “labour, power, to actually fuel the data centre demand is where the market will be very focused in the next 18 to 24 months”.

UBS’ Ermotti says he wouldn't jump to the conclusion “that we are now seeing a bubble for AI. But for sure, I think maybe investors will run out of patience in terms of just pouring cash into future potential cash flow. Eventually, it's very important to see the implementation phase starting and the non-IT sector start to benefit from it.”

Allianz’s Bäte also cites the elevated valuations these investments have attracted. “We can already see that in the prices. Effectively, data centre capacity prices – the implicit price of oil – are at US$300. There is enormous price being paid today, and I don’t see that being sold any time soon.”

There is a big issue between demand and supply, and he believes that if you are on the right side of the energy production and the supply, you will be doing good. “This is where we are spending some money.”

Bäte stresses that AI is already in his industry. “If I talk about insurance and asset management, particularly on the tech side, we already use 20% to 25% fewer programmers today.”

How soon

The issue for him, however, is whether AI can enter the real economy as quickly as predicted. “There we have some doubts in terms of the speed by which it will arrive.”

He reminds everyone that when the light bulb was invented, it took humanity 40 years to fully accept it. “We've become a lot faster to adapt. But we need society to accept that. Let me give you an example. We have had self-driving cars for 10 years now, and they're perfectly safe. But humans don't want to use them.

“Let's be a bit careful in terms of the optimism by which we will drive AI into everyone's lives.”

Investors’ worry is reflected in Moody’s 2026 AI Outlook report: “Concerns around a possible AI investment bubble are growing as capital spending far outpaces revenue, a US$245 billion gap in 2025,” it notes. “If this persists through 2026, market valuations could correct.”