|

|

Private credit has been the “buzzword” over the past few years, which is not surprising. For many companies that can neither access the public bond market ( or pay a very high coupon to get the deal done ) nor secure lending support from banks, this asset class is what has kept them alive and kicking in a high-interest-rate environment. On the demand side, investors are seeking an asset class that is not correlated with public markets, offers a good yield, and, most importantly, is less volatile than their public market portfolio.

The only criticism, if any, against private credit is the lack of exit/liquidity options for LPs. Unlike private equity, in which GPs get an exit via an IPO or strategic sale ( to a company in the same industry or to another PE firm ) and provide liquidity to their LPs, the exit options for private credit LPs have been limited. Moreover, unlike private credit, there has been a thriving secondary funds ecosystem in private equity for decades in case the LPs need liquidity before the fund is able to exit their investment. But that is changing fast and, in the process, a new sub-asset class within private credit is being created – secondaries funds for private credit.

In the first half of 2025 alone, secondaries funds raised a record US$80.84 billion through final closes, surpassing previous records and indicating strong investor appetite for liquidity solutions in private markets.

Just in the last week alone, we came across the following:

Mechanics

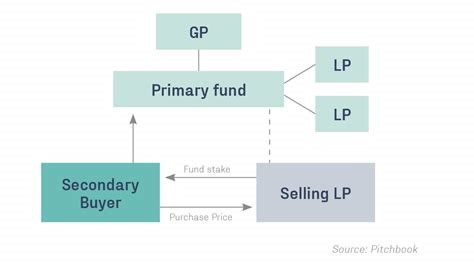

The chart shows the mechanics of secondary transactions. Some ( or all ) LPs in a primary private credit fund want an exit for liquidity reasons and sell their holdings in that primary fund to the secondary buyer, almost always at some discount.

These developments underscore the maturation of the private credit secondaries market, driven by institutional demand for liquidity and diversification. The increasing use of continuation funds and strategic shifts by asset managers reflect a dynamic landscape in private credit investing. It is only a matter of time when every serious private credit manager shall need to have a secondaries fund as well.

The next logical step in this evolution shall be the development and enhancement of tech infrastructure that can support pricing, risk, and transacting on a large scale with full transparency. Digitization will be key in determining how fast this sub-asset class/market grows from here as investor appetite is clearly not an issue.

Tanuj Khosla is a senior trader ( credit portfolio manager ), global markets, at Louis Dreyfus Company. The opinions expressed herein are solely those of the author.